Shifts Happen Fast!

Conventional board governance isn’t keeping pace with the uncertainty and rapid change of the 21st century. How can organizations ensure sustainable performance while managing risk? In the first part of a new mini-series, the authors of Adapt or Fail! share their expertise.

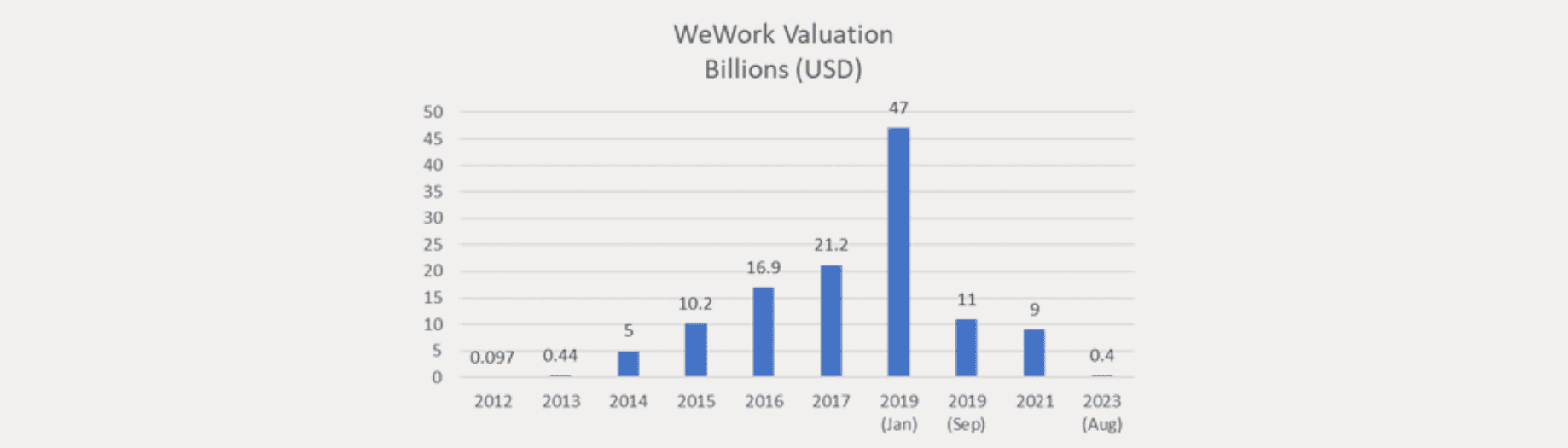

True shifts result in more than incremental change. They create sea change. They transform the environment. They create entirely different risks and opportunities. For example, WeWork, a coworking real estate company, was valued at $47 billion in 2019. It was optimized for an economy that assumed a growing number of white-collar office workers and a low-interest rate environment.

By 2023, neither of those assumptions were still valid. COVID had created legions of former office workers who now worked remotely, and interest rates were heading higher. By November of that same year, the company had filed for bankruptcy. WeWork was too finely adapted to a specific set of circumstances. When shift happened, it happened fast, and it couldn’t adapt.

Lessons Worth Learning

1. The momentum of change is accelerating exponentially

According to the Red Queen effect, constant adaptation and evolution are needed just to stand still and maintain one’s relative position. Unfortunately, standing still has proven to be a recipe for disaster for any organization over the long term.

A willingness to fail, to take intelligent and necessary risks must be embraced in order for organizations to innovate, adapt to changing circumstances and achieve the mission. Of course, unnecessary risks need to be avoided or mitigated.

The momentum of external change (its mass and velocity) is accelerating exponentially. Every day inevitably propels us toward more unforeseen crises. Shifts interact virally, potentiating one another. The result is a wave train of different tsunamis of change:

- Technical shifts.

- Scientific breakthroughs.

- Medical advances.

- Multinomics

- Cybersecurity threats.

- Environmental changes and demands.

- Workforce expectations.

- Demographic changes.

- Rapid regulatory changes.

- Artificial Intelligence and generative AI.

- Social media and instantaneous reputational risk.

The list is virtually endless. The market reflects this uncertainty and volatility. Between April 9 and April 25, 2025, the Dow Jones cumulative intraday swing was 39,000 points. Some of these were the largest in history. The daily average was 1300 points.

Every board and organization must nonetheless navigate these shifts if it is to adapt successfully.

2. Extreme uncertainty and instability will continue for the foreseeable future

Current and foreseeable conditions are extraordinary. WeWork ran into two ‘once-in-a-lifetime’ crises almost back-to-back. But in the 21st century, that’s not unusual; there seems to be a new once-in-a-lifetime crisis every couple of months or weeks. The Global Financial Crisis. Drought. Deluge. Pandemics. Market events. Wars. Changing trade and tariff rules. Regulatory threats. And, of course, competition.

Today’s competition is unlike previous eras, when conventional competitors attacked symmetrically. That is, they put their strengths against your strengths, betting that they could carve out a viable existence. Today’s competitors are just as likely to use an asymmetric attack, turning what you thought were your strengths into weaknesses.

Over-the-airwaves broadcasters thought their licenses provided a competitive moat, since they were limited. So, cable television attacked them with virtually unlimited choice. The licenses became irrelevant. Cable television thought that the massive infrastructure investments they had made was their defense against attack, and that any competitors would need to spend billions to compete. Streaming services turned that massive, fixed investment into a liability.

Asymmetric competition is growing in virtually every area. Amazon’s emphasis on logistics made physical stores a liability for many. Airbnb’s and Uber’s conversion of private property into core public services upturned the hotel and taxi industries.

This is why situational awareness (for early warning) and strategy (to take necessary risks intelligently and avoid being buffeted by unanticipated risks) work synergistically. With today’s pace of change resulting in a seemingly permanent state of uncertainty, it is far preferable to have a range of strategic options rather than be wed to a strategy developed for circumstances that no longer exist. It is also why developing a range of realistic options in advance (from the least to the most that could be done) is so valuable.

And if you are lagging, if the competition doesn’t get you, the activists probably will.

How prepared is your board and organization for these shifts, when they happen?

This blog was adapted from Rick Funston and Jon Lukomnik’s Adapt or Fail: A 5×5 Governance Framework for Boards of Directors (De Gruyter Brill, 2025).

Coming next week: Dinosaurs, Unicorns, Unicorpses and Zombies.

Out now in eBook and paperback

[Title Image by Giuseppe Ramos/iStock/Getty Images]